Retiring without a mortgage has a large positive impact on retirement confidence.

For decades the “Great Australian Dream” has been the general desire by most Australians just to own a home.

But that dream has morphed over time. These days it’s not just about owning a home but having the mortgage paid off either before retirement or soon after.

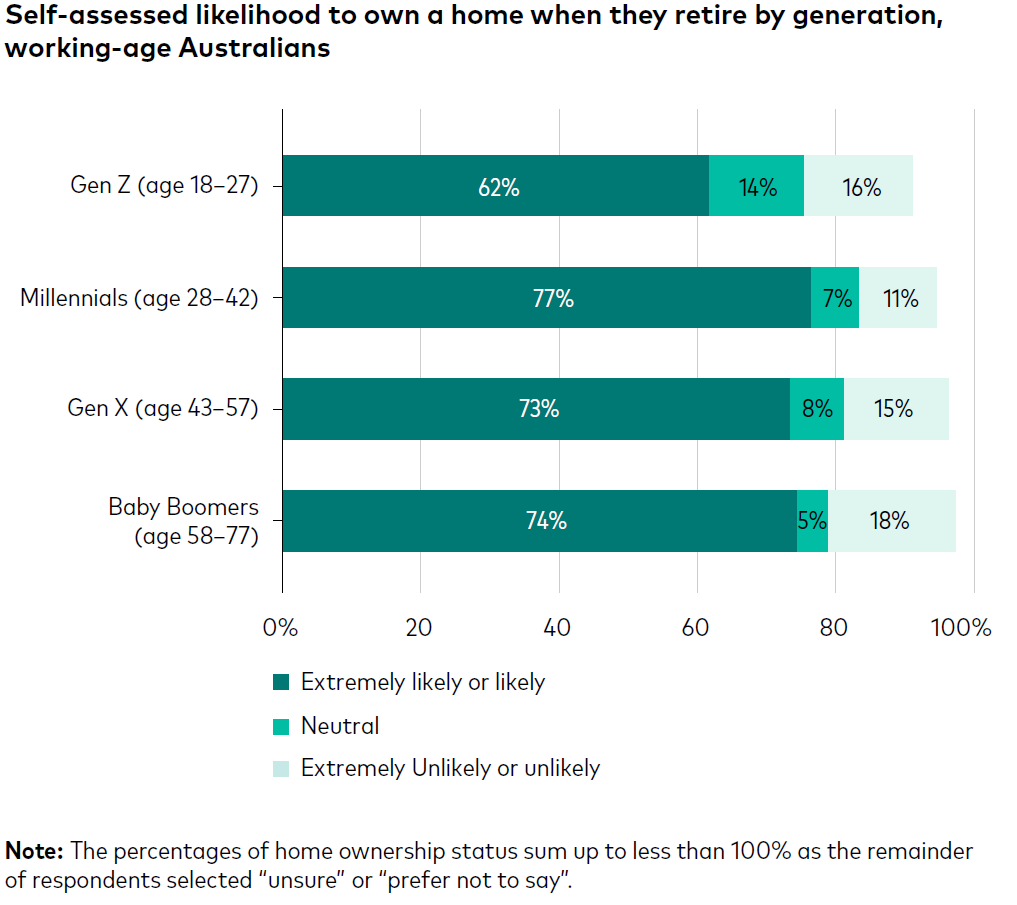

Vanguard’s 2024 How Australia Retires research has found that 32% of Gen X respondents who currently own a home with a mortgage – people who are approaching retirement age with limited time to pay off their debts before stopping work – expect they will still have a mortgage when they retire.

More than 1,800 Australians aged 18 years and over participated in the retirement research, which was conducted in March this year.

Of the Gen X population surveyed with a mortgage, 38% said they intend to keep paying their mortgage through retirement and 18% would consider selling their home and using the proceeds to repay their debt. 25% have plans to use their superannuation to pay off their mortgage in one transaction.

Of Millennials, 29% who either currently own a home or find it likely they will own a home in retirement also believe they will still be paying off their mortgage when they retire.

Gen Z is the generation most likely to believe that they will be paying off a mortgage at retirement. In fact, almost half (45%) of respondents in that generation who expect home ownership cited it is extremely likely or likely that they will still be paying off a loan.

Home ownership aids confidence

Not surprisingly, Vanguard’s research found that Australians who own a home outright are much more likely to be confident about their retirement outcomes than those who are still paying off a mortgage or renting.

Among the retired Australians surveyed, almost half (47%) of the people who owned their home outright said they were extremely/very confident in their ability to fund their retirement, and a further 38% were moderately confident. Only 16% said they were slightly or not at all confident.

Only 8% of retired Australians owned a home but still had a mortgage to pay. Among those retirees, 31% said they were extremely/very confident and 33% were moderately confident.

Around one in five (18%) of retired Australians are renting in retirement, while 8% own their home but still have a mortgage.

The percentage of retirees renting or with a mortgage is significantly higher (31%) for those who are not in a relationship (separated, divorced, widowed or never married) than those with a partner (8%).

Of retirees who are renting, more than half (57%) said they were slightly or not at all confident in their ability to fund their retirement.

The home as an asset

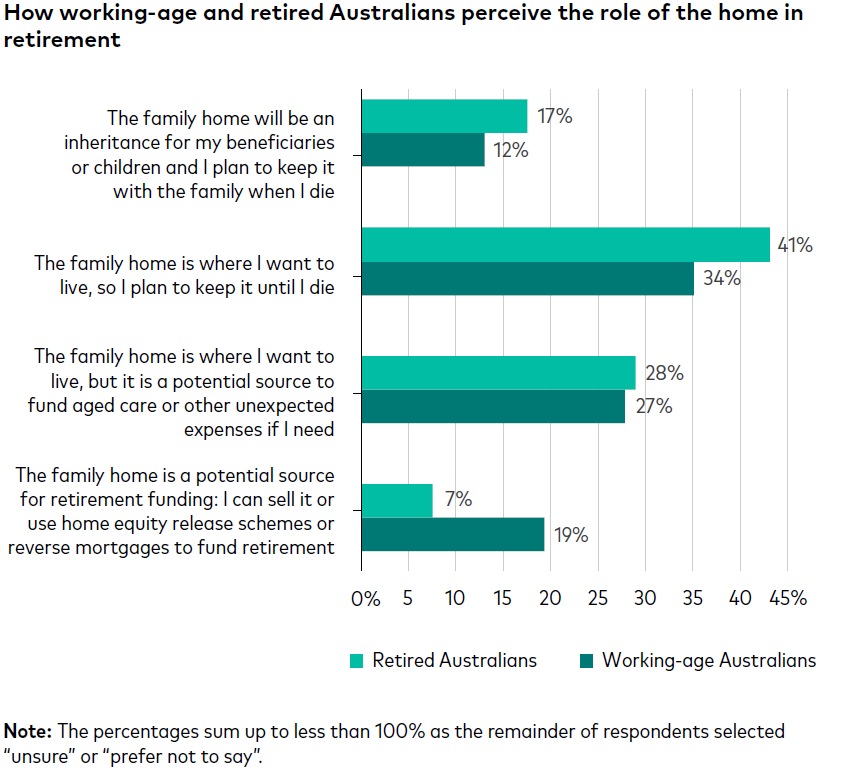

How Australians view the role of the family home varies by age group.

Vanguard’s research found that only 7% of retirees view their family home mainly as a source of funding and are willing to sell it or use home equity release schemes or reverse mortgages to fund their retirement.

By contrast, 19% of working-age Australians said they would potentially tap into the equity in their home.

27% of working-age Australians view their family home as where they want to ultimately live, but they also believe it can potentially fund aged care or unexpected expenses if needed. 28% of retired Australians believe the same.

Meanwhile, 34% of working-age Australians and 41% of retirees responded that they plan to stay in their home permanently, highlighting the unique role of housing in retirement assets.

A lower percentage of working-age Australians (12%) than retired Australians (17%) consider their family home as an inheritance for their beneficiaries or children.

Speak to us today if you have any questions.

Source: Vanguard June 2024

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing GENERAL ADVICE WARNING Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966). The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”). We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions. Important Legal Notice – Offer not to persons outside Australia The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws. © 2024 Vanguard Investments Australia Ltd. All rights reserved.

GENERAL ADVICE WARNING Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966). The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”). We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions. Important Legal Notice – Offer not to persons outside Australia The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws. © 2024 Vanguard Investments Australia Ltd. All rights reserved.