Making extra contributions into super can go a long way. Here’s some easy steps.

Each year, October 31 is designated as World Savings Day.

In fact, this year actually marked the 100th anniversary of the official launch of World Savings Day at the 1924 International Savings Bank Congress held in Milan, Italy.

It was a great idea then, and still is. The simple purpose is to highlight the importance of having a savings strategy, to put some extra money aside into a bank account or some investments.

In the Australian context, World Savings Day is a timely nudge to make extra contributions into your superannuation account (if you can) on top of the compulsory payments made by your employer.

A recent Moneysmart roundtable found many Australians are not knowledgeable when it comes to maximising their superannuation.

The superannuation knowledge gap

Employers are required under law to pay superannuation to their employees based on the current compulsory Superannuation Guarantee payment rate of 11.5% of a worker’s salary.

Superannuation contributions, up to the concessional contributions limit of $30,000 per person each financial year, are taxed at 15%. If an employer’s superannuation contributions fall short of the $30,000 limit, then individuals can make up any shortfall and their contributions will only be taxed at 15%.

Sounds fairly straightforward. Yet, Vanguard’s 2024 How Australia Retires research – which was based on a survey of 1,800 Australians – found that 36% of respondents were unsure if superannuation is taxed at a lower rate than other investments. A further 9% responded that it wasn’t.

And, while 76% of respondents did know they could contribute extra into their superannuation, the remaining 24% either didn’t know or responded that they couldn’t.

A recent Australian Securities and Investment Commission Moneysmart roundtable focused on millennials (people born between 1981 and 1996) and their finances also found that nearly half (48%) of those surveyed admitted they were not knowledgeable about maximising their super.

- 40% of Millennials don’t know what they pay in superannuation fees.

- 41% of Millennials don’t know or are unsure if superannuation is taxed at a lower rate than other investments.

- 37% of Millennials have no clear plan for retirement.

- Over half of Millennials do not know or are unsure of the minimum age for super access.

“Despite being the first generation to enter the workforce with compulsory superannuation from day one of their working lives, millennials are less engaged with their super compared to previous generations,” ASIC noted in a media release following the roundtable.

That many Australians have a patchy understanding of the retirement system is concerning. But it’s not surprising given the intricate rules that frame how much individuals can contribute to super at the concessionally taxed (15%) rate (which can include carry-forward contributions from previous financial years).

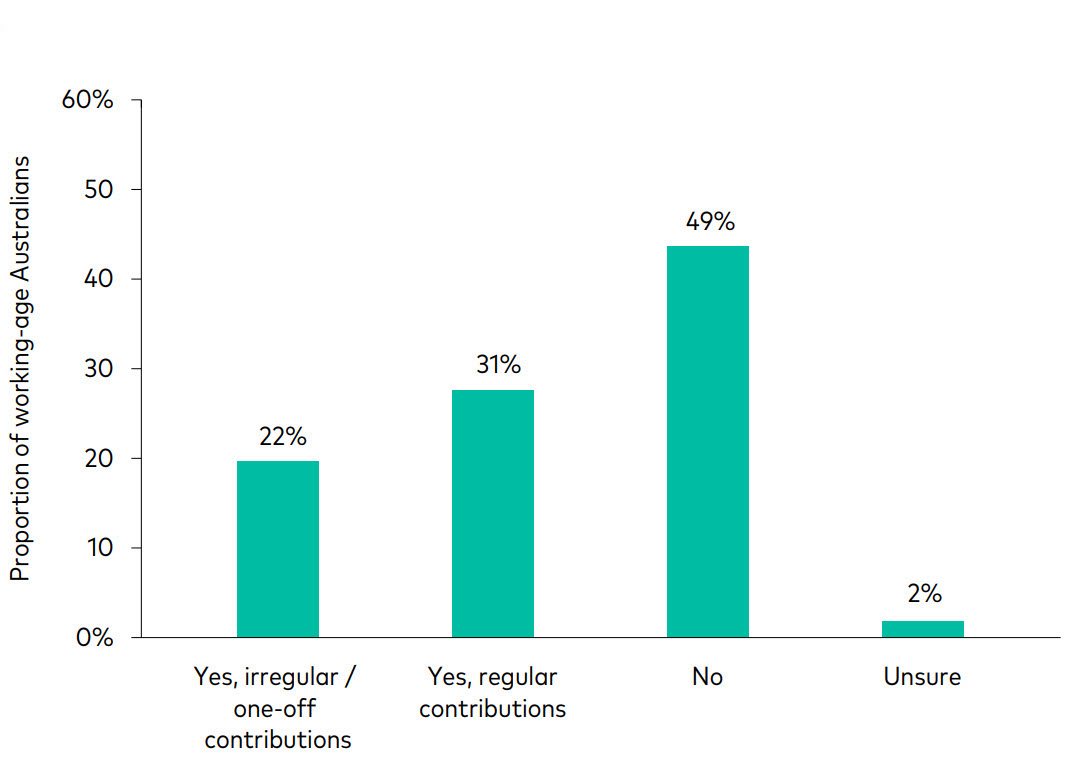

Another alarming finding from Vanguard’s retirement research was that almost half of working-age Australians (49%) have not made any personal (additional) contributions to their super, and more than a quarter (27%) have no plans to make future personal contributions as part of their retirement plan.

Additional super contributions made, working-age Australians

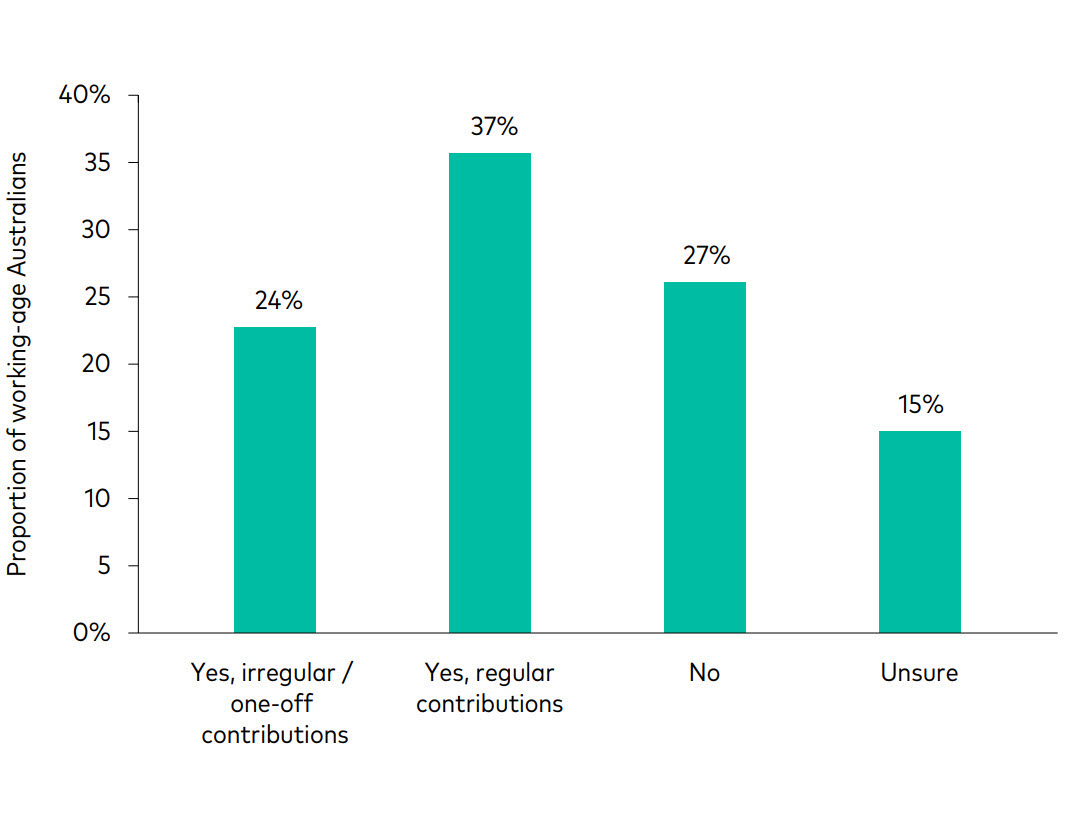

Plans for making future contributions, working-age Australians

Note: respondents can report plans to make both regular and one-off contributions

Positively, however, more than half of working-age Australians are open to making additional contributions in the future, with 37% willing to make regular contributions and 24% willing to make irregular or one-off contributions.

Ways to add extra into your superannuation

Concessional (before tax contributions)

This can be done either from your pre-tax salary via a salary-sacrifice arrangement through your employer, or by using after-tax money to deposit funds directly into your account.

If you deposit after-tax money into your fund, you may be able to claim a tax deduction in your next tax return given that concessional contributions are taxed at 15%.

Non-concessional (after-tax) contributions

Non-concessional contributions are after-tax personal contributions you may be able to make into your super fund, which can’t be claimed as a tax deduction.

They’re separate from your annual concessional contributions and are subject to their own annual limits.

The main advantage of making non-concessional contributions is to accumulate more of your money inside the super system.

Earnings from any investments inside your super account before age 60 are taxed at 15%. After age 60, if you have stopped work and access your super as a pension income stream, your investment earnings and the payments you receive are tax free.

The non-concessional contributions maximum limit is currently $120,000 each financial year. However, under what’s known as the “three-year bring-forward rule”, you may be able to make a $360,000 non-concessional contribution in one financial year.

Spouse contributions

The Australian Tax Office allows couples to split up to 85% of their annual employer concessional contributions, as well as additional salary sacrifice and personal super contributions.

But any splitting of contributions must be done after the end of the financial year in which the super contributions were made.

Super splitting can be done at any age, but a spouse must be either less than their applicable preservation age (the age at which they can access their super) or between their preservation age and 65 years, and not retired.

Couples wanting to split their super contributions first need to check whether their super fund allows it.

Consider an adviser

Super and retirement planning is a complex area.

Take care to understand the contributions types and limits carefully as there are significant tax penalties for exceeding the applicable contributions caps.

There are also aged-based limits on contributing into super.

If you’re unsure about your super options and need some advice, consider consulting a licensed financial adviser.

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing

GENERAL ADVICE WARNING

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966).

The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”).

We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions.

Important Legal Notice – Offer not to persons outside Australia

The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.